Welcome Free Budget Template

Free Budget Template

Establishing a clear budget allows you to know exactly how much disposable income you have coming in each month.

Make sure to factor in your mortgage repayments, debts, taxes, and necessities, plus make forecasts on how much extra you might need to pay in the event of an interest rate rise.

This way, you’ll be better prepared and not caught off guard. To help you get started, we have also create a how to guide.

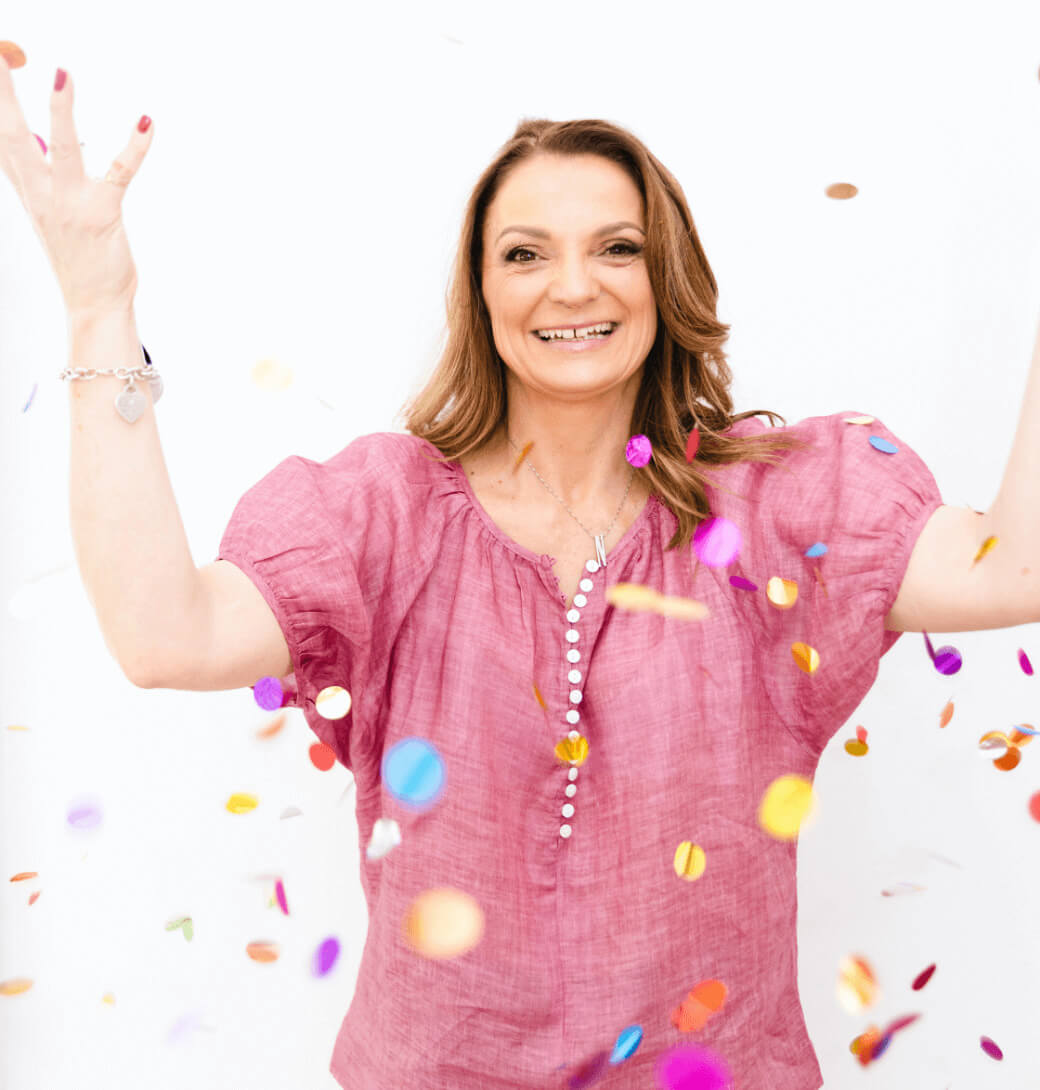

From when she started her very first job at 14, she has lived by a budget and always taught herself as much as she could about money and finance.

Nikki has always shared her budgeting and savings plans with her friends over the years, so it comes as no surprise that she now does this on a larger scale to help people purchase a home or grow their business.

She has always believed anything is possible if you put your mind to it and have the right tools. If someone tells her it can’t be done, she’s known for doing everything in her power to prove that person wrong and find a way to make it possible. This included becoming a fire-fighter in a former life!

Cherry Lending & Finance works closely with people from all walks of life, whether they’re looking to buy their first property, looking for an investment property, or struggling to find a home loan while self-employed.

“…anything is possible if you put your mind to it and have the right tools”

Nikki Berzin

Company Director

Frequently

Asked Questions

Some answers to your mortgage questions.

How much does the service cost?

Little to no cost to you as we are paid by the bank once we secure your loan.

When should I start talking to you?

As early as possible! Many people don’t start looking for a mortgage broker until they have found their dream house. Unfortunately they have often overlooked some important steps in the planning or are not ready to secure the loan they need.

Why choose a mortgage broker versus going direct to a bank or lender?

Once someone has experienced my service, and they realise the work and expertise involved, they’ll tell you you’re crazy to do it by yourself! I have access to 30 lenders and know the ins and outs of what each one can offer. I’ll match your specific needs to the best one. If you were doing this yourself, you’d be spending a lot of time and not necessarily getting the best deal for you. And it’s not just the actual loan, it’s about getting guidance on the entire process, of planning and working out the best approach.

Our Core Values

Subscribe for Financial Tips.

Receive monthly updates of the latest market + industry news

Nikki Berzin

Company Director

Join Now

Fill out the form below to recieve monthly newsletters.